Marvell AI Day Event Reinforces Growth Story

Marvell (MRVL) AI day event, as is normal with this kind of event, painted a picture of strong multi year growth and highlighted Marvell’s role in AI infrastructure. Marvell’s narrative was similar to Broadcom’s (AVGO) AI presentation (see Broadcom Primed For AI Era With Standards Based Approach ) – not a surprise since these two companies have been rivals for a long time now. The event, contrary to some expectations, was mainly about reiterating Marvell story without much new information.

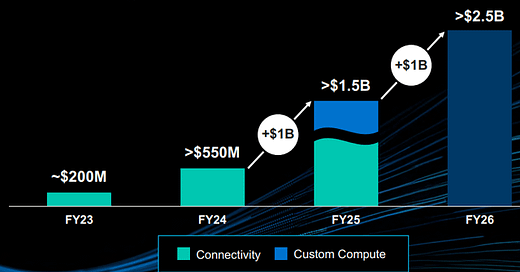

Note when looking at the images below that Marvell’s FY2025 started on 2/4/2024 and FY26 is approximately the same as CY25. As is well known, Marvell’s AI revenues are accelerating but off a small base (image below).

At “>$2.5B” in FY26 revenues, Marvell is a small player in the AI world. As covered in the article “AI Accelerator Market Will Morph Dramatically Through 2024”, Marvell benefits from AI much less than Nvidia (NVDA) or Advanced Micro Devices (AMD), Broadcom (AVGO) or Intel (INTC) and is roughly in the same league as Alchip.

Marvell’s Business Lines And Market Opportunity Are Similar To Broadcom’s

The company defines accelerated infrastructure a bit differently than others to include storage controllers – an area where Marvell has considerable product strength (image below).

The Company’s opportunity in the data center is network centric and very similar to that of Broadcom’s (image below)

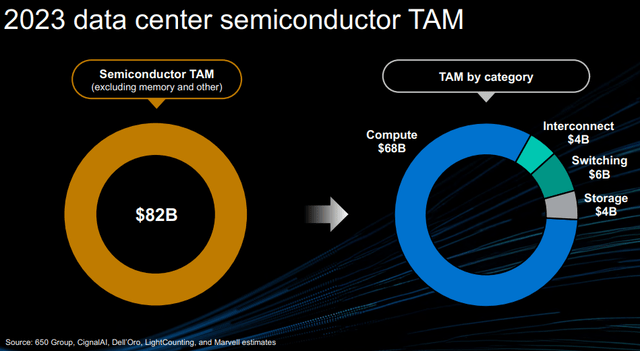

Marvell management presented its view of AI TAM which is worth reviewing (image below).

This is consistent with the $80B Semiconductor TAM estimate from Beyond The Hype as discussed in “Making Sense Of AI Silicon TAM”. As can be seen in the image below, Marvell subdivides the TAM to suit its segmentation.

Compute Is The Main Opportunity

The biggest piece of the TAM is compute and Marvell sees this TAM growing strongly for the next several years (image below).

Note that Marvell is forecasting the compute TAM to grow much slower than AMD’s forecast of >70%! Marvell does not serve the entire compute TAM but only the custom part of it. In other words, Marvell plans to only participate in hyperscaler custom XPUs and does not plant to compete in the merchant accelerator business against Nvidia and AMD.

Keep reading with a 7-day free trial

Subscribe to Beyond The Hype - Looking Past Management & Wall Street Hype to keep reading this post and get 7 days of free access to the full post archives.