TSMC: When Will Growth Overcome China Malaise?

TSMC (TSM) stock has been in the doldrums for a couple of years now – ever since concerns about China invading Taiwan became a big factor in the investor psyche. This fear factor continues even now as can be seen from the recent Taiwan-China headlines. It did not help that the semiconductor industry, mainly driven by Intel (INTC), stoked those concerns to garner tens of billions of subsidies for the US semiconductor industry under the “Chips Act”. The bursting of the COVID demand bubble helped further depress the stock although the impact of the COVID bubble bursting was lower on TSMC and the Company suffered less than most semiconductor players.

Recent History In Context

We can see from the quarterly revenue and EPS chart below that the post-COVID demand burst extended through the first three quarters of 2023. We can see that revenues have already inflected in Q3. Assuming TSMC hits around the mid-point of management guidance and grows revenues by over 11% in Q4, the COVID burst impact should be the rearview having lasted all of 2023.

While the COVID-burst gets most of the blame, a good part of TSMC’s underperformance during the last year comes from one name – Advanced Micro Devices (AMD). AMD’s business, especially on the client side, which drives considerable volumes at TSMC – went down steeply during this time.

Before the COVID burst, Beyond The Hype predicted that AMD would have a much bigger share of business at TSMC in 2023 than it currently does. The prediction did not pan out for two important reasons:

The post-COVID demand crush turned out to be much worse than anticipated due to inventory build leading to lower CPU demand at AMD.

Intel committed hara-kiri by pricing aggressively and letting the margins slip below 40% at the peak of inventory correction. Intel’s Hara-kiri, and AMD’s decision to not fight with lower pricing, was a set of developments that BTH did not expect.

It is highly likely that TSMC was planning for much higher client CPU volumes and that led to a major revenue shortfall. The COVID burst and AMD underperformance thus caused TSMC to underperform for the last year. That phase has now effectively come to an end.

The Industry Changed In The Last Couple Of Years

Setting aside COVID and AMD client market challenges, there have been four very important changes in the semiconductor industry in the last few years.

1. The AI Boom Has Fundamentally Altered The Demand For Leading Edge Nodes

When Beyond The Hype last wrote the TSMC thesis before the COVID burst, one of the key contentions was that as the leading edge process nodes got more expensive, it was going to be a challenge to find early adopters at the leading edge. With Nvidia (NVDA) optimizing for cost by picking laggard processes and AMD showing restraint in adopting new processes early, it appeared that both these key customers were comfortable staying one node behind Apple (AAPL). Intel appeared to be the only early adopter of TSMC’s N3 process other than Apple.

This dynamic has dramatically changed within the last year. With AI TAM exploding and becoming larger than any other slice of the semiconductor market, the incentive to produce the highest-performance chip is now off the charts. The company that produces the highest performance accelerators is likely to reap billions, possibly tens of billions, of revenues over the product's lifetime.

The race is now on between merchant semiconductor companies and CSPs to develop the highest-performance chips and this dynamic assures a rush to the most cutting-edge node. There is no choice for leading-edge ML competitors but to use TSMC. Beyond The Hype predicts that AMD and Nvidia will now join Apple as the drivers of the leading edge nodes at TSMC. Intel could also join this group but with an internal effort to make IFS successful, Intel will find itself on a divided path.

2. Moore’s Law Slowdown Is Distorting Industry Perception Of Process Leadership

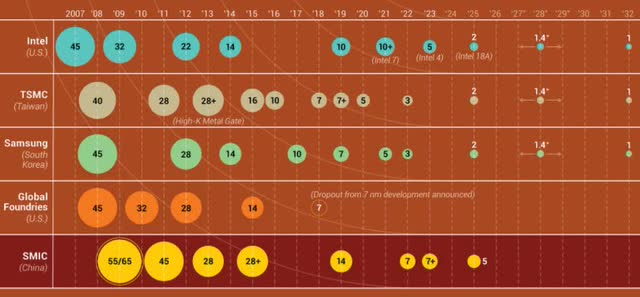

After decades of having a new major process node every two years, it took the industry about 2 ½ years to go from N5 to N3 and it appears that it will take another 2 ½ years to go from N3 to N2. It would not be surprising if it takes 3 years to get to the next process node after N2 (1.4nm or 14 Armstrong process). The image below from Nikkei gives an approximate idea of process node transitions at key industry players (see The great nanometer chip race ).

Longer times between process generations are making some investors and analysts think that TSMC’s competitors are catching up to TSMC. While this perception may be true in terms of process generations, being behind a process generation means being behind by 3 years as opposed to 2 years in the past. The key here is that investors should not confuse Intel and Samsung being 1 generation behind TSMC to mean that these competitors have narrowed the gap with TSMC.

The reality of the semiconductor business is that leading-edge chip developers like AMD, Nvidia, Intel, and CSPs will flock to TSMC for access to the leading-edge process. There is very little incentive for these companies to switch to Samsung or Intel when they have an equivalent process available 2 to 3 years later. By that time, these customers would likely move on to their next-generation products. Given this dynamic, Samsung and Intel will struggle to build critical mass on their leading-edge processes.

Keep reading with a 7-day free trial

Subscribe to Beyond The Hype - Looking Past Management & Wall Street Hype to keep reading this post and get 7 days of free access to the full post archives.