SolarEdge Or Enphase?

SolarEdge (SEDG) Q3 results came in line with the earnings preannouncement (See Solar Edge & Enphase: Where Do We Go From Here?). This article is a minor update that looks at segment-level trends and what they mean for SolarEdge recovery.

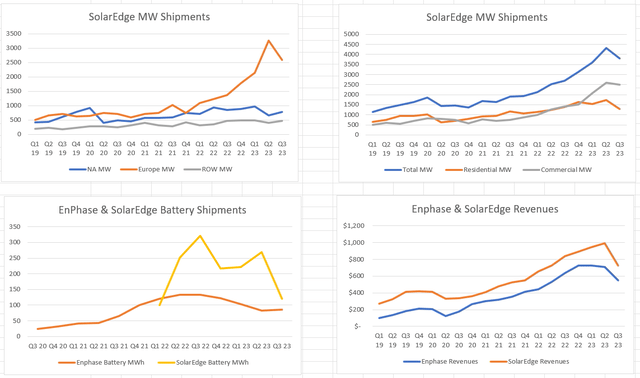

Revenues of $725.3M were 27% lower than Q2 and 13% lower than Q3 2022. The Company shipped 3.3 million power optimizers (down more than 50% from the Q4 2022 peak) and 274,000 inverters (a more modest drop of 18% from the Q2 2023 peak). Battery shipments of 121MWh were down 55% from 269 MWh in Q2. What these numbers tell us is that SolarEdge took the hardest hits in Europe and in the residential sector even as the commercial sector held up reasonably well. This becomes clearer when one looks at the historical data and compares SolarEdge’s performance against that of Enphase’s (ENPH) (Images below)

As can be seen in the image above, SolarEdge’s battery business took a much bigger hit than Enphase’s. The weakness appears to be primarily from Europe – given the Company’s larger footprint in Europe, SolarEdge took a bigger hit than Enphase.

Even though the Company’s ASP remained largely unchanged during the quarter, Gross margins – both GAAP and Non-GAAP - took a dive because of the big revenue cliff (image below). These margins are unlikely to recover back to the recent Q2 levels for several more quarters. This creates a big headwind for the net income and EPS through at least H1 2024 (i.e. for at least three more quarters).

Underlying Dynamics Point To A Complex Picture

In the US, the Company seems to be close to a new post-NEM3 baseline in a higher interest rate era. Management commentary suggests that slightly deteriorating residential demand was offset by moderately strengthening commercial demand. On the battery front, while the demand is strengthening, the market is oversupplied, and management expects price reductions to become more competitive. The battery price reductions will add to the margin pressures going forward.

While Europe is the most challenged geography, management reported that each of the submarkets behaved differently in Q3. Quarter-over-quarter revenue dropped 43% in Germany, 40% in the Netherlands, 41% drop in the UK, and 67% in Poland. On the other hand, revenues grew by 37% in France and 11% in Switzerland.

The rest-of-the-world solar revenues, representing roughly 9% of the Company’s revenues, decreased 3% compared to Q2 and flat compared to Q3 2022. The rest of the world markets are mostly driven by commercial demand and the overall revenues are holding up well despite opposing demand dynamics at a country level. This is promising in the sense that the rest of the world is likely to be a large growth driver in the future.

This unevenness in performance is expected to continue as local factors – including the inventory situation, new product launches, local net metering challenges, and commercial/residential splits – create different demand profiles in each of the markets. For example, the management is optimistic about demand in Germany, the largest rooftop solar market in Europe, because the government has announced a long-term goal to reach 215 GW by 2030. For this goal to be achieved, Germany would need to install approximately 20 GW of solar each year compared to about 7.5 GW in 2022 and 10GW+ in 2023. The Swiss and Austrian markets grew significantly in 2023 and are expected to continue to grow in 2024. On the flip side, Netherlands demand is dramatically down from peak levels due to uncertainty around net metering policies and the new baseline demand will not be known until the revised policies are in place. The Company is seeing mixed prospects in Italy, with commercial demand growing even as residential demand is declining. All things considered; management expects European demand to hold up well post-inventory correction.

Keep reading with a 7-day free trial

Subscribe to Beyond The Hype - Looking Past Management & Wall Street Hype to keep reading this post and get 7 days of free access to the full post archives.