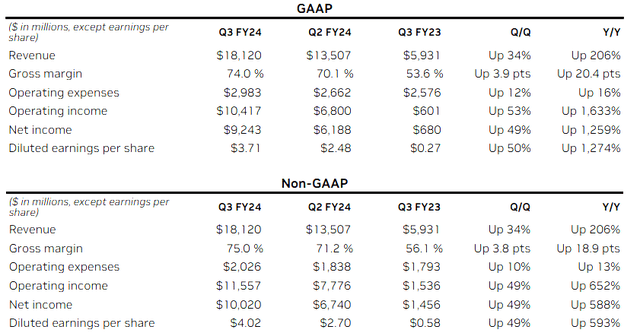

Nvidia (NVDA) delivered strong Q3 FY24 earnings well ahead of guidance and expectations. Revenues of $18.1B (see image below) were about $2B over guidance. Very impressive although part of the strength likely came from the rush to deliver products to China before new restrictions kicked in (and an approximately $2B boost in Singapore sales that was likely also part of the China funnel). EPS grew spectacularly to $4.02 on a non-GAAP basis.

The Company’s guidance for Q4 FY2024, $20B in revenues at about 75% gross margin, was also spectacular and above expectations. As such, there is very little to complain about Nvidia’s results or guidance. The Company is vastly outperforming expectations.

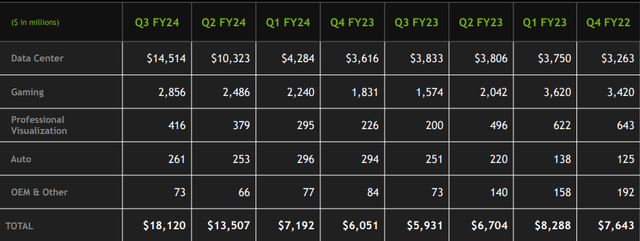

The segment level breakdown (image below) shows that the entire strength and growth is coming from a single segment – Data Center.

The other segments are becoming increasingly immaterial. It is all about the Data Center now.

The Data Center demand, as discussed previously, is from an unsustainable one-time boom in demand at a time when the company had/has no meaningful competition and could get away with inflated pricing. The margins of 75% are a testament to this. (as such management noted that the margins would be about 2.4% higher if not for the impact of inventory charges)

Some Highlights And Implications

Here are some key nuggets from the call and their implications:

Keep reading with a 7-day free trial

Subscribe to Beyond The Hype - Looking Past Management & Wall Street Hype to keep reading this post and get 7 days of free access to the full post archives.