Nvidia Is Off To The Races Once Again, Can AMD Slow It Down With MI355?

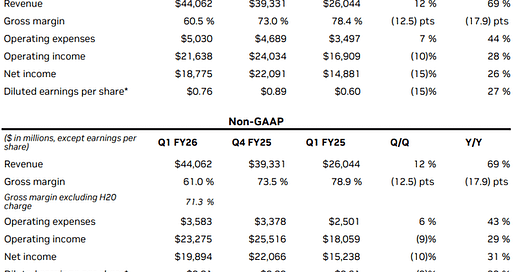

Nvidia (NVDA) delivered an above guidance but slightly soft Q1 FY26 results. Revenues of $44B grew 69% year-over-year despite an abrupt H20 sales shutdown. Despite the April 9th sales halt, Nvidia shipped $4.6B worth of H20s to China in Q1 and management claimed that it could have shipped another $2.5B without the sales halt.

Nvidia reduced the H20 related write down to $4.5B as the Company was able to reuse certain materials. The H20 write down impacted gross margins significantly with Nvidia posting margins about 10% below expected levels (image below with details).

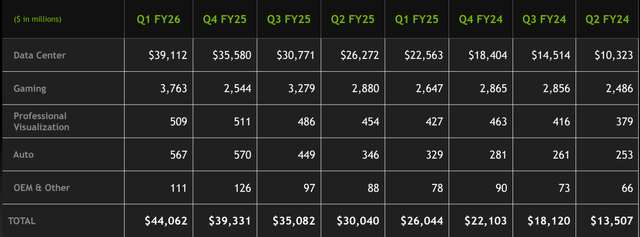

Segment level breakdown continues to show a heavily data center centric business although the “Gaming” segment delivered a strong growth (image below). The strong 48% Gaming growth is likely entirely attributable to AI as there is no evidence of meaningful growth in the console business or the PC gaming business.

The sequential growth in the data center segment would have been better without the H20 sales restrictions. Without that restriction, Nvidia would have delivered a quarter consistent with the recent growth trends.

In the Data Center segment, management commented that Blackwell contributed 70% of Compute revenues and the transition from Hopper is nearly complete. Note that 30% of Compute revenues amount to approximately $10B. In other words, excluding China, Nvidia sold only about $5.4B of Hoppers. Beyond The Hype estimates that hyperscalers have now essentially moved on to Blackwells with Hoppers being bought almost exclusively by second-tier CSPs, enterprises, and sovereign players.

Keep reading with a 7-day free trial

Subscribe to Beyond The Hype - Looking Past Management & Wall Street Hype to keep reading this post and get 7 days of free access to the full post archives.