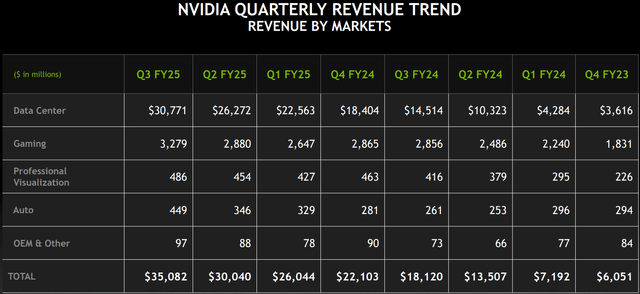

Nvidia (NVDA) Q3 FY25 earnings beat guidance as the Company once again registered a now customary $4B growth in the key data center segment. (From $10B to $14B to $18B to $22B to $26B to $30B as can be seen from the image below. Given the metronomic rhythm, the results were very much in line with expectations. However, $4B growth every quarter is a progressively smaller percentage, and some investors were expecting more.

Gross margin of 75% (image below) was down sequentially, primarily driven by a mix shift from higher margin H100 to lower H200 (although the management did not state is such). While the margin was lower, it was in line with expectations.

Beyond The Hype finds investors and analysts tying the margin decline mostly to Blackwell ramp inaccurate. Looking at Q3, management noted that H200 sales ramped hard to double-digit billions, suggesting that H100 sales were likely roughly on par with H200 sales (maybe about $13B each). Management also commented that it shipped about 13,000 Blackwell samples in Q3, suggesting that the Company did not sell any Blackwells in Q3. H200 ramp was the main reason for the margin downtick as H200 has 141GB of HBM compared to 80GB for H100. It is possible that revenues from China tariff compliant products, which grew strongly during the quarter, impacted the margins somewhat but the incremental China market revenues pale compared to H200 revenues. The Company’s ongoing slide in networking sales also likely did not help the margins. As can be seen from the image below, networking is now an increasingly smaller part of Data Center revenues.

While management continues to spout strong Networking narrative, the numbers tell a different story. Once again Networking underperformed compared to Compute. While Compute grew from $22.6B in Q2 to $27.6B in Q3, Networking fell from $3.7B in Q2 to $3.1B in Q3. Networking attach rate fell precipitously from about 16% in Q2 to about 11% in Q3. Given that management claimed that Ethernet revenues grew during this time, it means that InfiniBand revenues fell even more sharply than the above numbers indicate. Broadcom (AVGO) Ethernet is replacing Nvidia’s high margin InfiniBand design wins. This is also contributing to the margin decline.

Keep reading with a 7-day free trial

Subscribe to Beyond The Hype - Looking Past Management & Wall Street Hype to keep reading this post and get 7 days of free access to the full post archives.