Intel (INTC) Q1 2025 revenues came in at $12.7B at the high end of guidance range. Management attributed the strength to accelerated purchasing ahead of tariffs but could not quantify the tariff related pull-ins. Gross margins and EPS beat expectations comfortably due to higher revenues and a curious mix-shift to older generation products (more on this later).

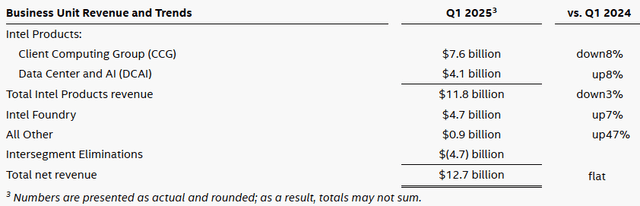

The Foundry segment benefited due to the unexpected spike in sales of previous generation products. The table below shows the year-on-year comparisons, and the picture is not that promising. The losses in CCG and DCAI are primarily reflective of the market share losses to Advanced Micro Devices (AMD).

The segment comparisons are challenging because Intel has changed how it reports its segments. Intel moved the edge portion of the previous NEX group into CCG and auto business from “All Other” into CCG. Intel also moved the networking portion of NEX, which includes Xeon sales, into DCAI. And, finally Intel moved Altera, Mobileye, and IMS equipment business into All Other.

These changes reduce the visibility of the core x86 CPU business and tend to make the x86 business look better than it really is. With that caveat, CCG revenues fell steeply by 13% quarter-over-quarter despite higher-than-expected volumes due to “competitive environment” (i.e. AMD taking market share) and “product mix” (i.e. ASPs dropping as Intel cedes the high-end to AMD and moves increasingly to lower ASP products).

One of the more fascinating commentaries of the earnings call was that Intel is seeing a strong mix shift towards older N-1 and N-2 generation products. So much so that the Company is now tapped out of capacity on its 7nm lines. These fully depreciated/written-down lines yield products at a very low cost and coupled with high utilization yield high margin to Intel. When asked about the reason for the mix shift, Intel noted that OEMs are choosing to move to older products to support lower customer price points. While there is merit to this argument, there are reasons to be skeptical of that claim.

Management commented that Intel is not pushing the N-1 parts for better margins, but investors should note that Intel is hurting on Lunar Lake margins, likely more so since the recently rumored TSMC (TSM) price increases. Management made a case that, OEMs have ridden the cost curves down older platforms and that lets them offer products at a lower price point. While there is merit to OEMs using older Intel parts to enable lower cost products at a time of economic uncertainty, that is unlikely to be the main reason for the mix shift.

A key dynamic to note is something Beyond The Hype has been pointing out for several quarters now. Intel, due to its IDM model, is most competitive with chips made at its own fabs. But the chips made at Intel fabs are N-1 and N-2 generation. The current generation (N) parts are made at TSMC and are not performance competitive with AMD. The combination of these factors is likely the #1 reason for the mix shift.

Keep reading with a 7-day free trial

Subscribe to Beyond The Hype - Looking Past Management & Wall Street Hype to keep reading this post and get 7 days of free access to the full post archives.