Broadcom Set For Growth Inflection In 2026

AVGO Q3 FY25 Earnings

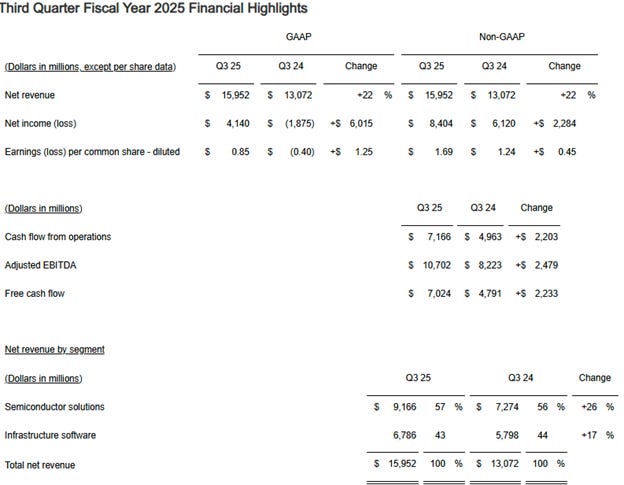

Broadcom (AVGO) delivered a slight beat on revenues and EPS for the recently concluded third fiscal quarter of 2025 (ended August 3rd). The highlight of Q3 was AI revenue of $5.2B – which grew 63% year over year. Note that this number puts Broadcom’s AI business at roughly 11% of Nvidia’s (NVDA) revenues and comfortably above Advanced Micro Devices’ (AMD) estimated $3B in AI revenues (including AI GPU/CPU/Networking). Broadcom is most certainly the undisputed #2 AI semiconductor name at the current time.

While the growth was strong and slightly above guide (image below), the real story of the earnings call was about strong forward guidance which exceeded investor expectations in a big way.

Note in the financials above that the Infrastructure Solutions segment is a smaller part of the revenue mix than in the past despite the large price increases at newly acquired VMWare. The non-AI semiconductor part of the Semiconductor Solutions business was flat sequentially at $4B and is increasingly a smaller part of the business. These two areas – non-AI semiconductor solutions and infrastructure including VM Ware – will keep shrinking in significance and will be increasingly less relevant for the Company as AI business grows. This note will focus on the AI story as that is the predominant driver of Broadcom’s valuation going forward.

The current growth at Broadcom is clearly being driven by Google (GOOG) for two different needs. The first and the most dominant one is that Google is seeing high demand for Gemini since Gemini 2.5 launch (as an aside, Beyond The Hype has switched to Gemini for most of the AI work since Gemini 2.5). The second is that Google now seems to be soliciting external customers for its TPUs. While the external customer component is small, it adds to the strong Gemini driven demand.

The guidance suggests that Broadcom’s growth story is evolving beyond Google as we head into 2026.

Guidance Points To Next Phase Of Evolution

To begin with, continued strength in AI and VMware are expected to drive Q4 consolidated revenue of $17.4B, up 24% year-on-year. Management forecasted infrastructure software revenue of $6.7B, up 15% year-on-year and semiconductor revenue of $10.7B, up 30% year-on-year. AI semiconductor revenue is expected to be $6.2B, up 66% year-on-year. Note that Nvidia guided $54B in revenues for the next quarter, which suggests that Broadcom is hanging at 11% of Nvidia revenues for the time being.

But Q4 guide was not what the call was about. The most important highlight of the call was a disclosure that a fourth customer (beyond the 3 already in production) has placed a $10B+ order and the Company expects to ship most of it in Q3FY2026 (i.e. May/June/July). That timing must make one wonder if Advance Micro Devices (AMD) or Nvidia (NVDA) would have gotten this business if not for the ASIC, and that discussion is covered in a later section.

Given that the Company had AI sales of $5.2B in Q3, $10B incremental revenue is a very large number. Not surprisingly, management has upped its growth target for FY2026 to be meaningfully ahead of previously guided range of around 60%. This is a meaningful revision and analysts are likely to ramp up 2026 numbers as a result.

An interesting revelation during the call was that TPU business was growing rapidly with the Company gaining share at existing customers (i.e. customers deploy more ASICs as a percentage of total deployment with each passing year). The growth of TPUs at existing customers and new customers means that networking business becomes less significant over time. Based on its growing share at current customers, management feels confident that ASIC share of the market will rise over time and ASICs will increasingly replace GPUs at hyperscalers.

In one of the more seemingly exciting statements in the call, management claimed that the current consolidated backlog for the company hit a record of $110B of which about half was semiconductors and the dominant part of that was AI. In other words, the Company now has a backlog of over $25B or AI semiconductors. Assuming a less than one year backlog, this points to about $30B or more in AI revenues for the next twelve months. This represents a nice ongoing growth from about $6.2B AI forecast for Q4 but that is to be expected since the Company expects to grow well above 60% during its fiscal 2026. In other words, the $110B backlog number is much less impressive or meaningful than it sounded during the call.

Keep reading with a 7-day free trial

Subscribe to Beyond The Hype - Looking Past Management & Wall Street Hype to keep reading this post and get 7 days of free access to the full post archives.