Broadcom: Inflection Point Ahead

Broadcom (AVGO) delivered a strong Q4 FY25 with revenue beating expectations by about $500M. Q1 FY2026 guidance also beat consensus by about $500M. Both AI semiconductors and Infrastructure software exceeded expectations although AI is the main source of strength.

A solid set of results and guide. No doubt. But, for a stock with a rich valuation like AVGO, were the results and guidance enough? Before we discuss that, here is a brief review of the numbers.

The Numbers Look Terrific

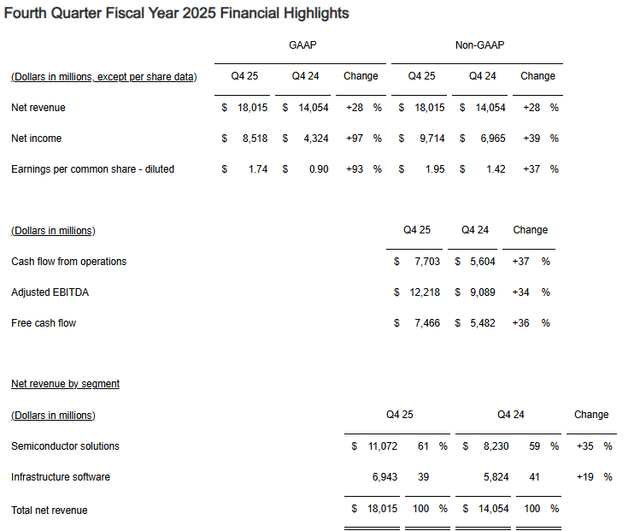

The main thing to note in Q4 results is that the semiconductor business (+35%) is growing much more rapidly than the infrastructure software business (+19%). The growth of AI semiconductors (not shown in the image below) is even stronger. AI revenue grew 65% year-over-year to $20B for FY25 and the custom accelerator business doubled year over year.

CEO Hock Tan confirmed that the 4th customer from whom Broadcom received a $10B order last quarter was Anthropic and that chip was Ironwood - same as Google (GOOG) TPUv7. Broadcom got another $11B order for delivery in late 2026. This was clearly an upside to expectations from a retail viewpoint, but supply chain sources have been signaling a huge order uptick recently and the upside was already baked into the stock.

While the order upside was baked in, analysts do not appear to have considered that Anthropic orders are rack/systems orders, and several components of the rack will be at pass through or low margins from Broadcom perspective. This will reduce the gross margin for this business.

Broadcom also acquired a 5th XPU customer through a $1B order for delivery in late 2026. Management was non-committal on whether the order is from OpenAI, leaving room for different interpretations. It is possible that this is from OpenAI or a different customer.

Hock Tan noted that current AI backlog is over $73B spread over 6 quarters. This was out of a total Company backlog of $162B. Of the $73B, $53B is for accelerators and $20B is for networking, optics, and racks. Order backlog for networking AI switches exceeds $10B.

The numbers suggest less than $55B in AI backlog for FY26. Given the long lead times, especially with TPUs, the odds do not favor a big upside to 2026 although there could be a strong upside to 2027. BTH tentatively expects FY2026 to be close to $60B – which appears to be the current buy side expectation.

Silicon-wise, Hock Tan noted that TSMC (TSM) is continuing to honor Broadcom’s ever increasing capacity requests and wafer capacity has not been a problem so far. In an interesting revelation, Hock Tan noted that Broadcom is building an advanced packaging fab in Singapore. The Company believes it has enough demand to justify a packaging fab. Hock Tan sees it helping with cost, availability, and supply chain security.

Q1 FY26 consolidated revenue is expected to be $19.1B. Semiconductor revenue is expected to be $12.3B and AI revenue is set to double year-on-year to $8.2B. Infrastructure software revenue is expected to be $6.8B at an anemic 2% year-on-year growth. Q1 gross margin is expected to be down approximately 100 basis points sequentially, due to a higher mix of AI revenue.

Broadcom also confirmed that OpenAI shipments will be 2027 (note that they were supposed to be H2 2026, but the ASIC schedule slipped). Margins are likely to decline further as Broadcom starts shipping lower margin rack business for Anthropic starting Q2 and will get worse when OpenAI shipments start.

For FY2026, the Company expects AI to drive most of the growth, non-AI semiconductors to be stable, and Infrastructure software revenue to grow at low double digits. Despite the weak prospects from the non-AI part of the business, 2026 is shaping up to be a gangbuster year for Broadcom. 2027 also appears to be strong based on OpenAI’s ramp.

While the Broadcom story appears extremely strong with all Google, Anthropic, and OpenAI ramps, a dark cloud is starting to gather.

MediaTek Set To Eat Broadcom’s Lunch

Beyond The Hype has been discussing the risk of Broadcom losing some of Google business to MediaTek for about an year! The concern a year back was that Google would be using MediaTek for inference starting 2026. Such a change would cause Broadcom to lose a large share of business at Google. Fortunately for Broadcom, the MediaTek project faced ongoing delays for the next several quarters. A project that was supposed to go into production in Q1 or Q2 2026 moved out to Q4 2026.