ASML: Thesis Is Changing

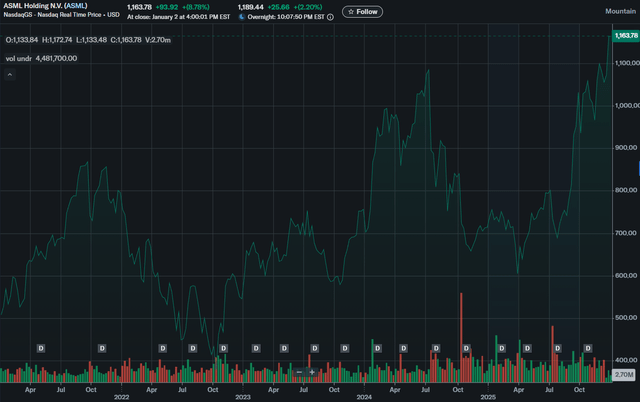

ASML Holding NV (ASML) stock has been choppy since post-COVID peak in 2021. After the post-COVID meltdown and after much of the Intel (INTC) excess build out was walked back, it was a good time to add ASML at 5% of the Beyond The Hype portfolio Q2 2023 (this was from before BTH moved to the Substack). As it turned out there was more choppiness in 2024 as the Intel story further collapsed and TSMC (TSM) chose not to adopt the high-priced High-NA EUV technology and persisted with the lower priced EUV technology.

On December 29 2024, as part of the Q1 2025 Portfolio Update, BTH increased ASML allocation from 5% to 10% with the thesis:

“ASML continues to be in very much a sole source position like TSMC but has taken several hits it can during the last few years as bad news dominated the semiconductor industry (except AI). But most of the bad news is in the rear view now and logic and memory (mainly HBM) business upgrades should drive strong growth going forward. ASML. Allocation goes up from 5% to 10%.”

The thesis has worked out well so far. ASML stock moved up from about $700 to about $1166 as of the writing of this article. Not a bad 66% return.

The question now is where the stock goes from here. There are several key forces that will be pushing ASML performance over the next year to two years. In no particular order, they are:

The insatiable AI demand – which is a major positive

The ongoing delays of TSMC adoption of High-NA EUV – this now seems delayed past the next two generations at least and ASML will see very little upside from High-NA EUV because of this until 2030.

TSMC has also stopped increasing the number of EUV layers for newer processes. The 19 to 25 layers at N3 may be the peak and future processes are estimated to remain in the low-20s range for the foreseeable future. To the extent that investors are expecting higher EUV layer count, it is not going to happen.

Intel, contrary to the expectations of the bulls, is making slow progress on the process side. 14A is a much higher risk venture than the market seems to realize.

Memory vendors are amid adding capacity due to AI boom which is a clear positive although memory processes do not use much in the form of EUV equipment.

Samsung, the biggest memory player, and an early adopter of EUV for memory, has decided to cut the number of EV layers for its 1C process although Micron (MU) may increase its EUV layer count with the 1 gamma process – especially for HBM4.

The China trade limitations and the threat of prototype local EUV machines have gotten considerable ink in the recent past. Some investors see China as a short- or long-term risk.

Potential competition from startups, especially xLight which has got much ink, has caused some investor concern.

Clearly, there are several cross currents here. How is ASML likely to fare going forward?